The one-time death allowance for the dependents of the laborer.

Wed, 24 May 2023 15:03:00 | Print | Email Share:

Mrs. Tran Thi Kim Hanh (from Thai Nguyen province) asks about the case where a laborer has contributed to social insurance for 14 years and 3 months. Due to poor health, they took unpaid leave in October 2020 and finalized their social insurance records in February 2023. Mrs. Hanh inquiries about the entitlements for the dependents if the laborer passes away from cancer.

Regarding this matter, the Social Insurance Department of Thai Nguyen province provides the following response:

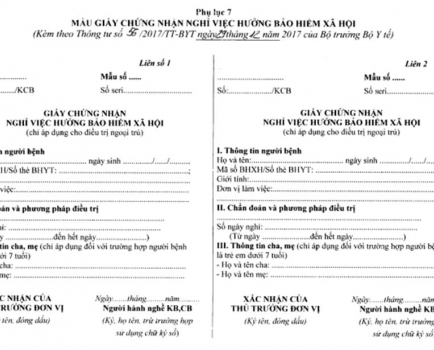

In the case presented by Mrs. Hanh, if the laborer with 14 years and 3 months of social insurance contributions, who is currently on a suspension period, passes away, the person responsible for funeral arrangements will receive a one-time funeral allowance as prescribed in Article 66 of the 2014 Social Insurance Law. The dependents of the laborer will be entitled to a one-time survivorship allowance according to the regulations stated in Articles 67 and 69 of the 2014 Social Insurance Law.

Specifically, the allowances are as follows:

Funeral allowance: The funeral allowance is calculated at 10 times the basic wage level of the month in which the individual passed away, as specified in Paragraph 1, Article 66 of the 2014 Social Insurance Law.

One-time survivorship allowance: According to the provisions of Article 69 of the 2014 Social Insurance Law, if the dependents of the laborer, who is currently on a suspension period as mentioned above, pass away, they will receive a one-time survivorship allowance. The amount of the one-time survivorship allowance is calculated according to the regulations stated in Paragraph 1, Article 70 of the 2014 Social Insurance Law as follows:

- The one-time survivorship allowance for the dependents of the laborer who is actively participating in social insurance or is on a suspension period is calculated based on the number of years of social insurance contributions. Each year is calculated as 1.5 times the average monthly wage contribution for the years before 2014; 2 times the average monthly wage contribution for the years from 2014 onwards; with a minimum of 3 times the average monthly wage contribution.

- The average monthly wage contribution serves as the basis for calculating the one-time survivorship allowance as stipulated in Article 62 of this Law.

By: Translator: LeAnh-Bizic/According to Hai Hoa (Government Newspaper)

---------------------------------------------

Same category News :

Other news :