Will the VAT rate be reduced in 2023?

Thu, 01 Dec 2022 09:54:00

Ms. Nguyen Thi Tuyet (Khanh Hoa) is applying the tax rate of 8% according to Decree No. 15/2022/ND-CP for the collection, transportation and treatment of domestic waste. Ms. Tuyet asked, in 2023, what tax rate will be applied to the groups of goods and services that have enjoyed the above tax incentives?

What is the penalty for issuing false invoices?

Thu, 01 Dec 2022 09:54:00

Mr. Pham Thanh (Hanoi) asked, can the statute of limitations for sanctioning administrative violations on invoices is 2 years specified in Decree No. with administrative violations that ended in previous years (2021, 2020)?

Is the COVID-19 test fee taxable?

Tue, 29 Nov 2022 14:05:00

Mr. Tran Thanh Binh (Binh Duong) company operates in the field of road freight transport and is subject to VAT. The cost of freight includes the basic cost and includes the COVID-19 test fee (subject to not subject to VAT) for each driver.

Appointment of professional titles, consider increasing salary ahead of time?

Thu, 17 Nov 2022 14:25:00

Ms. Nguyen Thi Huyen (Dong Nai) is a Grade II primary school teacher, working since September 2014. At the end of 2020, she will be considered for a salary increase 6 months ahead of schedule and will be entitled to a salary increase from 2.67 to 3.0 in March 2021.

How to process sold invoices when customers returned goods?

Thu, 17 Nov 2022 14:25:00

Mr. Nguyen Van Khanh's company is using electronic invoices according to Decree No. 123/2020/ND-CP. The company's main activity is commerce, so it issues a lot of invoices for individual customers. Therefore, when the customer returns the goods, it is not possible to issue a return invoice to the company. Mr. Khanh asked, in this case, how should the company handle sales invoices?

Conditions for applying 0% tax on exported goods and services

Mon, 31 Oct 2022 09:59:00

Mr. Bui Quang Huy's company (Hanoi) has an e-commerce website providing dental product design services. The customer submits a request via the website, then the company sends the design and the customer pays via Paypal.

How to calculate PIT with allotment contract

Sat, 29 Oct 2022 09:43:00

Personal income tax (PIT) from the research is applied by Ms. Nguyen Mai Anh’s organization (Hanoi) according to Circular No. 111/2013/TT-BTC. Mai Anh asked, when signing a professional contract between the project leader and research members, is the total value of the contract before or after withholding PIT?

What is considered to be invoiced at the wrong time?

Fri, 07 Oct 2022 09:23:00

Company A operates from Monday to Saturday morning and hires unit B to perform customs declaration services and work overtime to clear export goods. But the time to be granted clearance by the customs is on Saturday afternoon (the time when company A is not active), so no e-invoice is issued on the day of customs clearance.

When should an auditor not perform an audit?

Mon, 03 Oct 2022 14:23:00

Reader has email address at phamcongxx@gmail.com sent an email to the Legal Counseling Office of Lao Dong newspaper to ask: Is it correct that the chief accountant has been out of work for more than a year and cannot perform an audit for the old business. Under what circumstances should an auditor not perform an audit?

Expenditures for projects belonging to the commune budget must be tax deductible?

Tue, 27 Sep 2022 15:29:00

Mr. Nguyen Hai Dang asked, based on Point b, Clause 5, Article 13 of Circular No. 80/2021/TT-BTC, works under the commune budget with a total investment of less than 1 billion VND are not subject to value added tax (VAT) deduction. Is that correct?

Can import and export entrustment service get tax reduction?

Tue, 27 Sep 2022 15:29:00

Ms. Nguyen Minh Thu's company (Hanoi) looked up Decision No. 43/2018/QD-TTg and found out that the industry code of the import and export entrustment service is 8299. However, when the company looked up the appendix of Decree No. 15/2022/ND-CP on value-added tax (VAT) reduction, this product code is not found.

Is the amount of fees left taxable?

Sat, 24 Sep 2022 15:29:00

The Traffic Vehicle Registration Center of Nam Dinh Province is a public non-business unit under the Department of Transport. In addition to the task of inspecting motor vehicles and inland waterway vehicles, the Center is also tasked with collecting road user fees on top of vehicles.

License fee rate when enterprises suspend production and business

Sat, 24 Sep 2022 15:29:00

Ngo Van's business temporarily suspended business from October 9, 2020 to October 8, 2021, then the business continued to carry out procedures to suspend business and was confirmed by the Department of Planning and Investment on October 7, 2021, the suspension period is from October 9, 2021 to October 8, 2022.

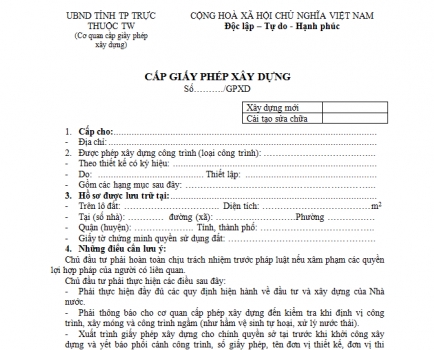

Does the construction permit application need to be accompanied by a tax receipt?

Wed, 21 Sep 2022 15:12:00

Mr. Truong Dinh Vuong (Ha Giang) made the application for a construction permit, had all the components according to the list of administrative procedures, but the Economic and Infrastructure Department replied that there was lack of receipts for payment of personal income tax on behalf of employees and construction tax according to the official dispatch of the District People's Committee issued in 2015

Will businesses continue to receive tax incentives when moving out of disadvantaged areas?

Wed, 21 Sep 2022 15:12:00

Ms. Vu Thi Ha's company was established in 2019 in Nam Cuong Ward, Lao Cai city, Lao Cai province. In August 2022, the company moved its business location to Lao Cai ward, Lao Cai city. Ms. Ha asked, how does your company receive corporate income tax (CIT) incentives, and how much is the time for tax incentives and reductions? What is the CIT payable rate?

Time to determine VAT reduction for construction activities

Sat, 17 Sep 2022 14:47:00

Ms. Nguyen Thi Thu Trinh's company (Quang Ngai) operates in the field of civil construction. In 2021, the company signed a package contract to build a police work house, the investor is the provincial police. The contract took effect from July 7, 2021 to January 7, 2022, but due to the impact of epidemics and natural disasters, the work was delayed.

Is the COVID-19 test fee taxable?

Sat, 17 Sep 2022 14:47:00

Mr. Tran Thanh Binh (Binh Duong) company operates in the field of road freight transport and is subject to VAT. The cost of freight includes the basic cost and includes the COVID-19 test fee (subject to not subject to VAT) for each driver.

How to process sold invoices when customers returned goods?

Thu, 15 Sep 2022 14:22:00

Mr. Nguyen Van Khanh's company is using electronic invoices according to Decree No. 123/2020/ND-CP. The company's main activity is commerce, so it issues a lot of invoices for individual customers. Therefore, when the customer returns the goods, it is not possible to issue a return invoice to the company. Mr. Khanh asked, in this case, how should the company handle sales invoices?