How are taxes and fees applied to land excavation for construction?

Sat, 26 Aug 2023 14:11:00

Nguyen Thi Ngoc Anh Company (Gia Lai) operates in the field of transportation construction consulting. In the process of preparing the design dossier for the construction drawing of a transportation project, there is a requirement for land excavation for the construction of the road with a compaction ratio of K0.95.

Deadline for registering family deduction

Tue, 22 Aug 2023 14:11:00

Ms. Tran Thi Du (Dak Lak) registered for a family deduction for her birth mother on March 21, 2023. In May 2023, she went through the tax refund process. Ms. Du asked if she can claim the family deduction for her mother from January 1 to December 31, 2022.

Tax declaration based on the time of receiving invoices.

Fri, 30 Jun 2023 10:30:00

In the case where the buyer receives an electronic invoice for the sale of goods or provision of services, which has a digital signature date later than the invoice creation date, the issued electronic invoice is still considered valid. The buyer should declare the value-added tax (VAT) at the time of receiving the invoice, ensuring compliance with the prescribed form and content.

The condition for entrusting a third party to issue an invoice.

Wed, 24 May 2023 15:03:00

Merchants and service providers who are enterprises, economic organizations, or other entities have the right to entrust a third party that has a connected relationship with the seller. The third party must be eligible to use electronic invoices and must not be in a situation where electronic invoice usage has been suspended, in order to issue electronic invoices for the sale of goods and provision of services.

What is considered as earned income in Vietnam?

Wed, 24 May 2023 14:14:00

In cases where a company in Vietnam pays income to an individual who is not a resident in Vietnam but performs work in other countries, that income is determined as earned income in Vietnam.

Will there be a penalty for not sending a notification of canceling the invoice to the tax agency?

Wed, 24 May 2023 14:14:00

Mrs. Nguyen Phuong Thao (from Hanoi) is the accountant of a company that is currently using invoices according to Circular No. 78/2021/TT-BTC. In 2022, due to errors made by her predecessor, when switching from invoices according to Circular No. 32/2011/TT-BTC to invoices according to Circular No. 78/2021/TT-BTC, the company did not send a notification of invoice cancellation using the form TB03/AC to the tax agency.

Can replacement invoices issued in 2023 be taxed at 8%?

Tue, 28 Mar 2023 13:55:00

Ms. Pham Thi Hien (Thai Binh) has issued a sales invoice at the tax rate of 8% in December 2022 and that invoice is a replacement invoice. By 2023, customers report that they need to issue invoices again because of a change in the quantity of goods allocated to member companies.

Time of issuing an invoice is the time of acceptance and handover of works

Tue, 28 Mar 2023 13:55:00

Ms. Mai Thanh Hien’s company (Binh Duong) operates in the field of construction and installation. According to Ms. Hien, refer to Decree No. 15/2022/ND-CP on VAT rates, some items will be reduced to 8% from February 1, 2022 to December 31, 2022; from January 1, 2023 the tax rate will be 10%.

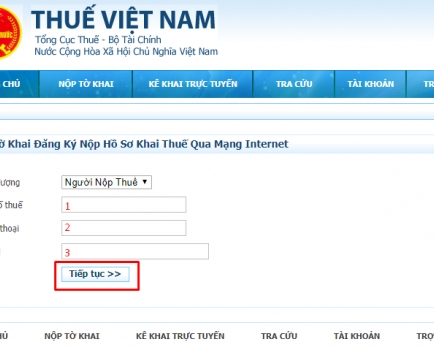

Can taxpayers pay taxes online?

Wed, 08 Mar 2023 13:38:00

Ms. Dang Thi Thao Nguyen (Da Nang) asked, can taxpayers pay taxes electronically (online)?

Instructions for handling faulty e-invoices

Tue, 28 Feb 2023 11:02:00

Ms. Dinh Ngoc Linh (Tay Ninh) asked, when canceling an invoice with the wrong quantity, wrong unit price, should she make a record of invoice cancellation for both parties to sign, or just make Form 04 and send it to the tax agency?

What do tax rate apply for service in 2022 and invocing in 2023?

Tue, 28 Feb 2023 11:02:00

Ms. Dang Thi Thu Trang's company (Dong Nai) has used some outsourced services that are eligible for VAT reduction from 10% to 8% and applied in 2022, now there is one last payment period for the service in December 2022, ending service on December 25, 2022.

Time to determine turnover to calculate taxable income

Tue, 21 Feb 2023 10:25:00

Mr. Tran Minh Hai's company specializes in providing technical design services and producing graphic images, advertising TVCs for real estate projects. After signing the contract, the investor usually makes an advance to secure the contract performance and requires the company to issue an invoice for the advance.

Invoicing in 2023 for service in 2022, what does tax rate apply?

Tue, 21 Feb 2023 10:25:00

Ms. Dang Thi Thu Trang's company (Dong Nai) has used some outsourced services that are eligible for VAT reduction from 10% to 8% and applied in 2022, now there is one last payment period for the cost. service in December 2022, ending service on December 25, 2022.

What tax rate do invoices in January 2023 apply?

Sat, 11 Feb 2023 10:20:00

According to Mr. Tran Lu's reflection, based on the Government's Decree No. 15/2022/ND-CP dated January 28, 2022 on tax exemption and reduction policies, Mr. Lu's business is eligible for VAT reduction from 10% to 8% applies to services from February 1, 2022-December 31, 2022.

Which income is subject to corporate income tax?

Tue, 31 Jan 2023 15:13:00

Income from credit activities for the poor and other policy beneficiaries of the Bank for Social Policies is income exempt from corporate income tax.

How does the contractor import equipment in the name of the contractor?

Tue, 31 Jan 2023 15:13:00

Mr. Tran Hong Anh (Hanoi) is a construction contractor with 100% foreign capital, established and operating under Vietnamese law in the form of a one-member limited liability company. The company is performing a project construction contract for an investor who is an export processing enterprise.

Is it allowed to write the name of the goods in a foreign language on the invoice?

Tue, 31 Jan 2023 15:13:00

Ms. Mai Thi Oanh Kieu (Quang Nam) has some imported products with foreign names, such as "Led ceiling lamp". Ms. Kieu asked, in this case, can the company issue an invoice according to the name of such goods?

Conditions for selecting investors of social housing projects in the form of bidding

Sat, 03 Dec 2022 10:24:00

One of the conditions for a social housing investment project to select an investor by bidding is the detailed construction planning already approved by a competent authority.