Comments on the draft Law on Special Consumption Tax (amended) and the beverage industry

Thu, 15 Aug 2024 14:13:00 | Print | Email Share:

On August 8, 2024, the Vietnam Chamber of Commerce and Industry (VCCI) in coordination with the Vietnam Beer - Alcohol - Beverage Association (VBA) organized a workshop on "Draft Law on Special Consumption Tax (amended) and the beverage industry".

Opening the workshop, Mr. Dau Anh Tuan - Deputy General Secretary and Head of the Legal Department, VCCI, said that, implementing Resolution 129/2024/QH15 of the National Assembly, the Ministry of Finance is collecting comments on the draft amendments to the Law on Special Consumption Tax (SCT) to submit to the National Assembly for comments at the 8th session in October 2024 and to the National Assembly for approval at the 9th session in May 2025.

Therefore, the workshop was organized to record and reflect opinions from the perspective of the beverage industry (beer, alcohol, soft drinks) on the Draft Law on Special Consumption Tax (amended).

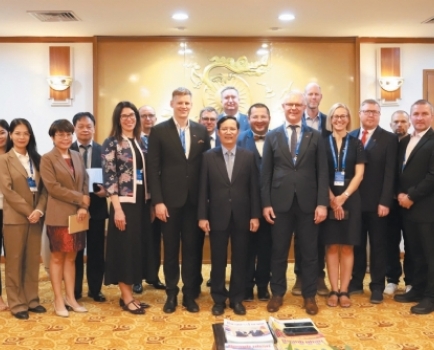

Overview of the workshop on the morning of August 8. Photo: Hai Anh

Ms. Nguyen Thi Cuc - President of the Vietnam Tax Consulting Association said that the special consumption tax aims to regulate goods and services that do not serve essential needs, do not encourage or limit consumption, or belong to the group of products that affect environmental pollution, public health, and social security.

The amendment of the Special Consumption Tax Law is consistent with the policies of the Party, State, and National Assembly on the prevention and control of non-communicable diseases, specifically through tax policies to minimize and control products that are harmful to people's health.

"We highly agree with the viewpoint of increasing special consumption tax on alcoholic beverages and beer. The tax increase needs to be in harmony to ensure consumption restriction, production and business orientation, and regulatory requirements of each country in each period, each certain historical stage" - Ms. Nguyen Thi Cuc shared.

In order for the Government's policy on protecting people's health to be effective as expected, economic experts also agree that, in addition to the special consumption tax policy, it is necessary to carry out other synchronous measures with Decree 100/2019/ND-CP regulating administrative sanctions in the field of road and railway traffic, and there must be drastic measures to combat smuggled goods.

Including in the management of paying special consumption tax on alcohol among the people, alcohol production without business registration, not ensuring quality causing poisoning, death, affecting people's health, and social order and security.

By: Song Linh (Financial Times)./Translator: LeAnh-Bizic

---------------------------------------------

Same category News :