Room for corporate bonds

Mon, 19 Sep 2022 15:09:00 | Print | Email Share:

Vietnam's corporate bond market is expanding quickly, but it is still small in comparison to other nations' markets and has a lot of room to grow.

With around 21.5% of the total capital supplied to the Vietnamese economy, the bond market has emerged as a significant source of funding.

Our projections for the capital structure of the economy in 2021 show that bank credit capital will account for 47% of the total, while capital raised from the stock market through IPOs, additional share issuances to existing shareholders, and the sale of shares in a variety of other ways only account for 3.2% of the total.

Significant capital channel

However, with around 21.5% of the total capital supplied to the Vietnamese economy, the bond market has emerged as a significant source of funding. This revelation demonstrates how much the financial sector has influenced our economy.

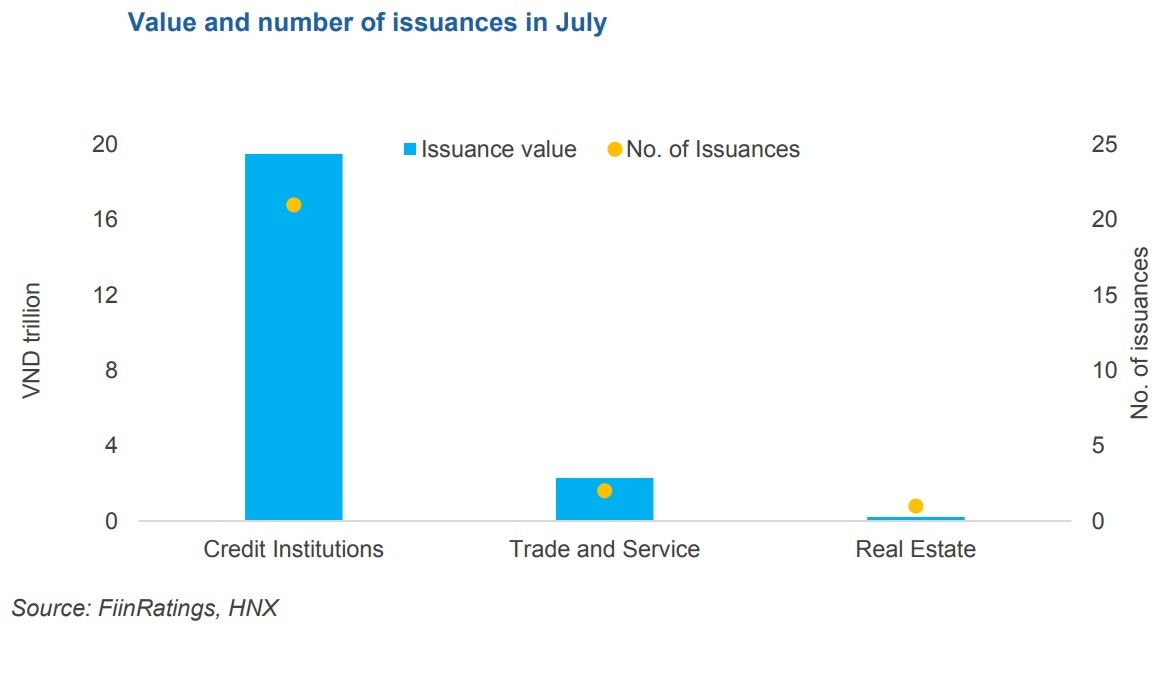

The bond market is clearly contracting and cooling off right now, and this matters. This is evident from the size at which bonds were issued in the first four months of this year, particularly the absence of the real estate sector, which had issued more bonds in April but whose total volume was only half that of the same period last year.

Is the decrease in bond issuance now a good thing? Many people want to know what the medium- and long-term funding sources are for businesses to recover and thrive in the near future.

The commercial banking system is today overwhelmed with medium and long-term loans, which make up 40% to 50% of all outstanding loans and constitute the primary role of the banking system. However, these loans have recently been difficult for the banking system to provide.

I want to underline how crucial it is for capital to flow through the stock market or the medium-and long-term bond markets. For a more wholesome and sustainable development, it matters how the bond market is governed and managed.

Despite a decline in bond issuance, the real estate sector continued to account for the majority of the total, followed by banking and construction, and the remainder came from other industries. To meet Basel II capital adequacy risk management rules mandated by the State Bank of Vietnam, the banking sector mostly issued bonds to raise tier-2 capital for equity.

Credit institutions make up around 25% of all bond investors in 2021, securities businesses about 26-27%, and then other investors.

In terms of terms and interest rates, many individuals have asserted that bond yields are relatively high. However, this is not entirely accurate because they actually range from 8% to 10%. The bond duration is barely three to five years. Over the past three years, businesses have issued a lot of bonds, but this year will be difficult for them since they have a lot of interest and principal payments to make.

Many people use the term "three-zero bonds" to describe the type of collateral. In fact, only roughly 18% of bond issuers lack any form of collateral. The remaining bonds are secured by collateral in the form of shares, assets created in the future, or other assets.

The Law on Securities and the Law on Enterprises, which both play significant roles in regulating the issuing of bonds, have existed in Vietnam legally over the years. There are also Decrees 163/2018, 81/2020, and 153/2020 included. Now comes the modified Decree 153/2020.

Remedy for the bond market

To expand the corporate bond market in a healthy and sustainable way, attention must be paid to the following crucial issues.

First, it is necessary to simultaneously expand the bond market and manage risks. In order to boost investor confidence and prevent setting a negative precedent, it is currently imperative to fully settle the recent controversies in the bond market.

Second, it's critical to complete a workable legal framework as soon as possible, for example by modifying Decree 156/2020 on administrative sanctions in the securities industry and Decree 153/2020/ND-CP on corporate bond placement.

Third, credit ratings should be controlled to make it easier for investors to evaluate the caliber of the bond issuers and the degree of risk attached to the bonds that have been issued.

Fourth, more precise controls on the scope, frequency, and terms of bond issuance are required in order to improve the quality of issued corporate bonds. Public purpose bonds must be encouraged and supported (simplifying the process of bond issuance, shortening the process of handling documents...).

Fifth, strengthening the corporate bond market's infrastructure, including creating a consolidated secondary market for corporate bonds, mandating the use of international accounting standards, and modernizing IT systems and databases...

Sixth, developing a platform for professional and diverse stock investors; supporting the development of institutional investors such as ETFs, open-end funds, pension funds, and so on; supporting investment trusts; raising financial literacy among citizens and new investors; requiring transparency from bond issuers; and providing types of bonds suitable for individual investors.

Seventh, strengthening bond inspection and supervision on the basis of risks, not merely administrative measures, while enhancing the legislative framework and the standard of bond market management and supervision.

By: Business Forum Magazine

Source: https://en.diendandoanhnghiep.vn/room-fornbsp-corporate-bonds-n35281.html

---------------------------------------------

Same category News :