New exchange rate policy not without risk

Thu, 03 Nov 2022 22:58:00 | Print | Email Share:

Exchange rate volatility is increasing due to geopolitical shocks across the globe. Thanks to its sound policy framework, Vietnam has remained largely immune to such international turbulence. However, exchange-rate depreciation is not without risks, writes Patrick Lenain, senior associate at the Council on Economic Policies.

| Patrick Lenain, senior associate at the Council on Economic Policies |

All over the world, central bankers are facing a perfect storm. High inflation, volatile financial markets, signs of recession, energy disruptions, and heightened geopolitical risks jeopardise price stability and financial stability. Stock market indexes have collapsed in many countries, inflicting severe financial losses on investors. Bond markets are not the safe haven they usually provide to investors in turbulent periods, as bond prices have followed the downtrend of equity prices. Foreign exchange markets have seen large volatility, with the US dollar gaining strength against all currencies.

Reacting to high inflation, all central banks have tightened monetary conditions. They have hiked their policy rates, reduced their purchases of financial assets, and announced that tightening will continue until inflation is well under control – even at the cost of slower economic growth and higher unemployment.

Fortunately, this perfect storm is well-managed. Having learned lessons from previous disasters, monetary authorities and government officials have pre-empted a financial crisis. In the United Kingdom, a sudden meltdown of the bond market following unwelcome budgetary statements by former Prime Minister Liz Truss was stopped by the Bank of England with a massive injection of liquidity. In Switzerland, a violent speculative attack against Credit Suisse, based on unfounded rumours, was quickly repelled when the bank appeared well-capitalised. Further incidents are likely in tense markets.

Emerging markets are also confronted with multiple risks. The US dollar has appreciated strongly, borrowing costs are high once again, inflation often reaches double digits, and global monetary tightening puts investors on hedge. Fortunately, no major emerging market country has defaulted on its debt service obligations. Investors can now well differentiate across emerging markets and do not run away from well-managed countries. Policymakers in emerging countries are well-trained to navigate the turbulent waters of crisis management. International institutions such as the International Monetary Fund (IMF) are ready to help with emergency loans rushed when help is called for.

The resilience of markets until now does not preclude the absence of future turbulence. Unexpected shocks, such as a dangerous escalation of the Russia-Ukraine war, would test the resilience of markets. Barring such extreme shocks, the hope is that central bankers will continue to provide a safe pair of hands around the world in these troubled times.

Successful management

Thanks to its sound policy framework, Vietnam has remained largely immune to international turbulence.

Annual consumer price inflation increased to 3.9 per cent in September, in line with the target rate of 4 per cent set forth by the government, and below inflation rates in other Southeast Asian countries such as Malaysia (4.5 per cent), Indonesia (5.95 per cent) and Thailand (6.4 per cent).

The pace of price increase in Vietnam could increase in the coming months as government officials allow underlying costs to be passed to retail prices – such as for fuel, electricity, food, and telecommunication. Beyond this short-term uptick, inflation is approaching its peak, as in other countries, thanks to declining commodity prices in global markets. In their recent world economic outlook, IMF experts project Vietnam’s inflation to reach 3.9 per cent in 2023, roughly the same pace as presently.

The State Bank of Vietnam (SBV) has shown its resolve to keep inflation under control. On October 25, the SBV lifted its refinancing rate from 5 to 6 per cent, its discount rate from 3.5 to 4.5 per cent, and its overnight inter-banking lending rate from 6 to 7 per cent. This second increase in a month will pre-emptively act to curb inflation, as done by central banks in other countries, such as the US Federal Reserve.

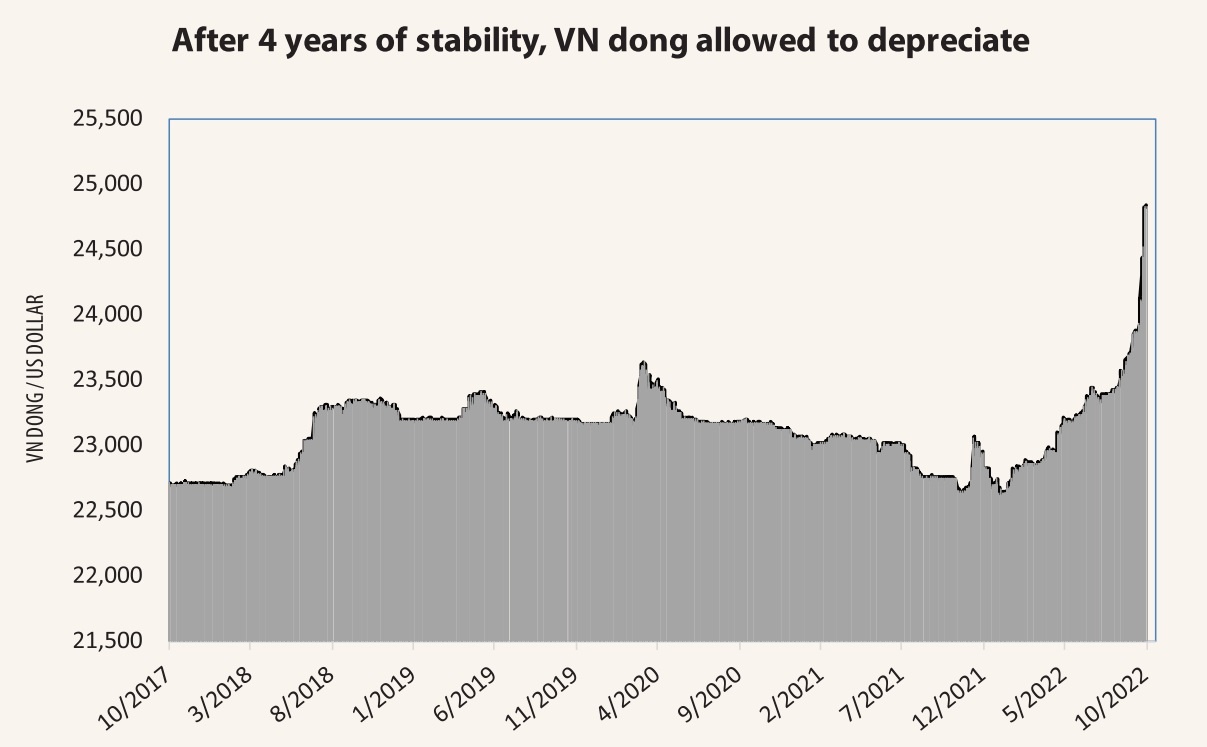

The SBV has also allowed greater exchange-rate flexibility. The central bank follows a so-called “crawl-like” policy: it contains the exchange rate within a trading band centred on a moving reference rate. In a sharp turnaround, the SBV has allowed a rapid depreciation of the VND/USD since mid-2022.

On October 25, the SBV set the daily reference rate for the US dollar at 23,703 VND/USD, with a trading band of 22,520-24,788 VND/USD, allowing the foreign exchange market to trade at the top of the band. The exchange rate reached nearly VND25,000 per USD by end-October, a sharp decline of almost 9 per cent from levels observed before the policy change.

Reflecting concerns

Firstly, moving in tandem with the strong US dollar implied a significant appreciation of Vietnam’s currency relative to large trading partners, such as European countries, thus undermining the competitiveness of Vietnamese exporters. Secondly, China has allowed the Chinese yuan to depreciate faster than VND, thus resulting in a rapid appreciation of the bilateral rate. Vietnam’s currency reached 3,326 VND/CNY in September, much stronger than 3,600 VND/CNY in February. Vietnam has now brought its currency more in line with China’s currency, although further realignment is to be expected.

Allowing greater flexibility of the exchange rate will protect the SBV’s foreign exchange reserves. While the central bank holds a significant amount of foreign assets – about $105 billion – it has intervened in the market since April to respect the trading band. Foreign exchange reserves need to be safeguarded in case an unexpected crisis occurs. The wider trading band will reduce the need for market intervention and protect the existing financial buffers.

Yet, the rapid depreciation of the VND/USD rate is not without risk. A weaker currency in a highly dollarised economy will push up inflation, as exchange rate depreciation will “pass through” to domestic prices. Keeping inflation within the 4 per cent target rate will prove more difficult, perhaps requiring further hikes in interest rates, which will weigh down on economic growth.

Another risk is that Vietnam’s weaker currency will inflict financial losses upon foreign investors holding sovereign bonds denominated in VND. Faced with financial losses, foreign investors may not want to invest again, thus jeopardising future capital inflows.

Finally, Vietnamese businesses that have borrowed in US dollars will suffer from an increase in their indebtedness expressed in domestic currency. According to the IMF, bank lending in foreign currency amounted to VND583 trillion ($25.3 billion) in 2021. The government holds foreign currency debt for about 38 per cent of total debt, which will become more expensive to repay.

In the current crisis, central banks need to navigate turbulent waters. They must chart a course that avoids treacherous obstacles such as runaway inflation, severe recessions, and defaulting borrowers.

In Vietnam, like in many other emerging markets, monetary policy’s greatest responsibility is carefully managing the exchange rate. Too much rigidity would risk repeating the mistakes made during the Asian financial crisis of the late 1990s, while too much flexibility could destabilise expectations, stop capital inflows, and push foreign-currency borrowers to the brink of default. With its proven expertise, it is hoped that the SBV will plot a safe direction towards calmer seas.

By: Patrick Lenain/ Vietnam Investment Review

Source: https://vir.com.vn/new-exchange-rate-policy-not-without-risk-97590.html

---------------------------------------------

Same category News :