Is wastewater fee subject to VAT?

Fri, 31 May 2024 10:45:00 | Print | Email Share:

Clarification on VAT for household wastewater.

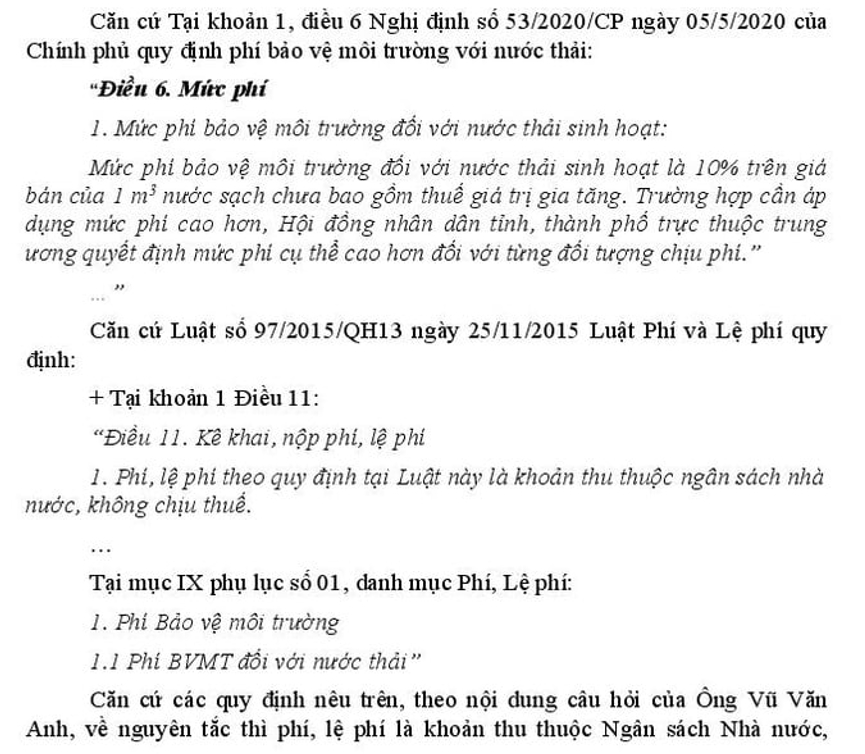

Question: Based on Decree No. 53/2020/NĐ-CP dated May 5, 2020, which regulates environmental protection fees for wastewater. In Clause 1, Article 6, "The environmental protection fee for household wastewater is 10% of the selling price of 1m3 of clean water excluding value-added tax". So, is the wastewater fee subject to VAT?

Example: My family uses up 100m3 x 10,000đ/m3 = 1,000,000đ; wastewater fee = 1,000,000đ x 10% =100,000đ. So, does my family have to pay VAT on 100,000đ (100,000x10%VAT=10,000đ)?

Answer:

By: According to PV (Financial and Business Magazine)./ Translator: LeAnh-Bizic

---------------------------------------------

Same category News :

Other news :