In this case, is the VAT rate for aluminum ladder items 10% or 8%?

Fri, 29 Mar 2024 14:43:00 | Print | Email Share:

Addressing the confusion regarding VAT for a trading company selling to businesses in the export processing zone, specializing in aluminum ladders.

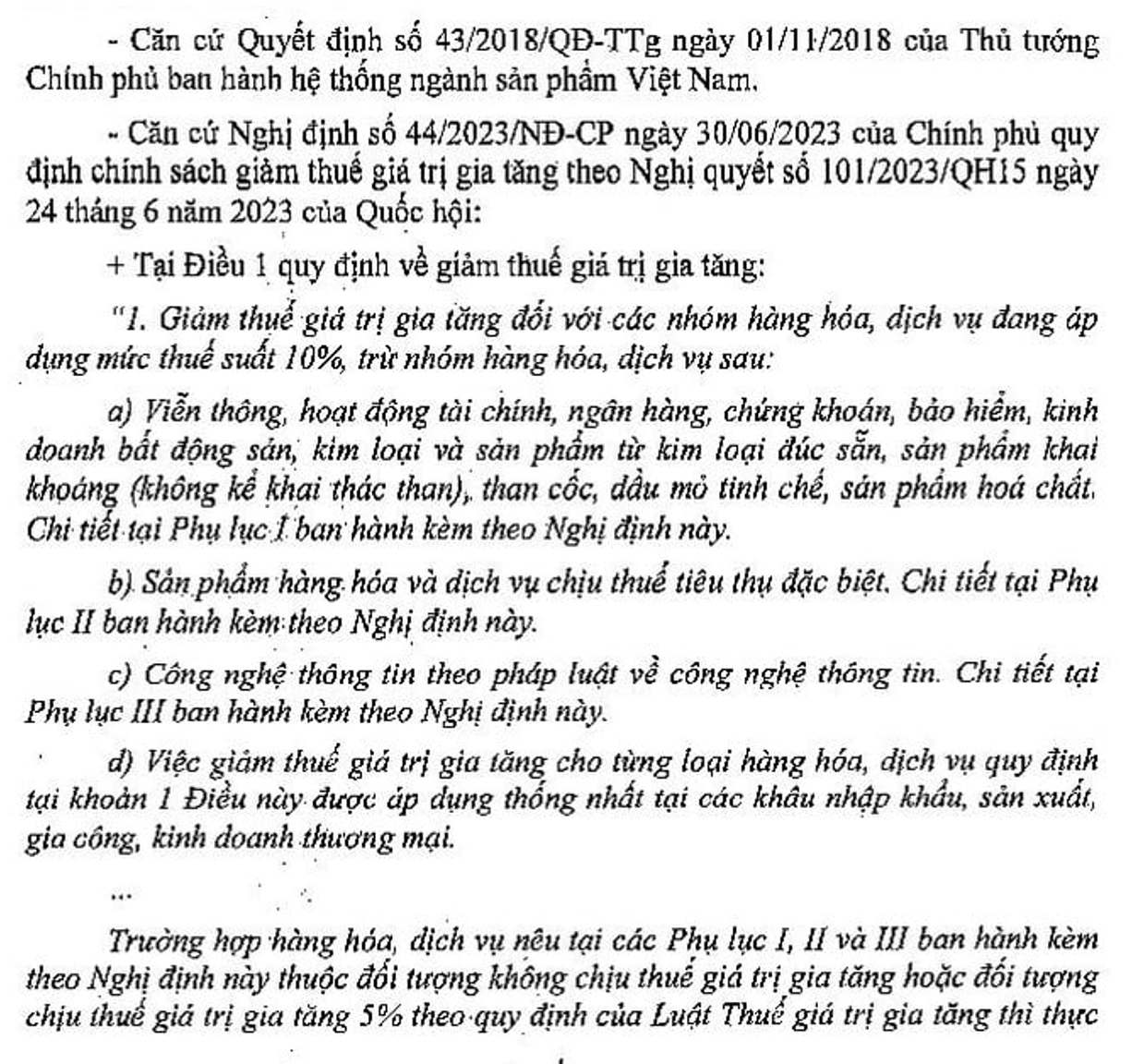

Question: Our company is a trading company selling to businesses in the export processing zone specializing in aluminum ladders. The VAT invoice for purchases is 10%, and the importer is assigned HS code 76169990. We processed the tax refund at a rate of 10%. However, during the refund procedure, the Tax Office of Bac Tu Liem District informed us that aluminum ladders belong to the group eligible for a reduced VAT of 8%, so only 8% can be refunded. They do not accept the 10% refund based on our purchase invoice. We would like to inquire whether in this case, the VAT rate for this item is 10% or 8%? How should we handle this situation in accordance with the law?

Response:

By: According to PV (Corporate Finance Magazine)/ Translator: LeAnh-Bizic

---------------------------------------------

Same category News :

Other news :