Financial Leasing: Opportunities for Accessing Capital for Small and Medium Enterprises

Wed, 02 Oct 2024 14:31:00 | Print | Email Share:

Financial leasing is an effective medium- to long-term capital access channel, particularly suitable for small and medium enterprises (SMEs), especially in the current context of numerous difficulties and challenges.

The seminar, organized by the Center for Support of Small and Medium Enterprises, the Vietnam Chamber of Commerce and Industry (VCCI), in collaboration with BIDV-SuMi TRUST Financial Leasing Company, aims to help businesses expand their opportunities to understand the current state of capital access.

Businesses "Facing Challenges" in Accessing Capital

In her opening remarks at the seminar, Ms. Tran Thi Thanh Tam, Director of the VCCI Center for Support of Small and Medium Enterprises, stated: "Currently, Vietnam is increasingly integrating into the international market, signing numerous Free Trade Agreements (FTAs), which has brought many positive impacts on the country's economic development. The import-export market has expanded and diversified, and the financial services market has developed further with the participation of foreign investors. The institutional framework and policies are gradually being improved to meet integration requirements and fulfill commitments in FTAs.

"Although the government has issued many credit support policies to address difficulties and help SMEs participate in the value chain and access capital, VCCI has also implemented numerous activities to assist businesses in accessing and enhancing financial sources and solutions, thereby diversifying funding for enterprises to meet their production and business needs and growth aspirations.

"However, according to VCCI's survey, over the years, especially in 2023, one of the biggest challenges faced by businesses is accessing capital and markets," Ms. Tam reported.

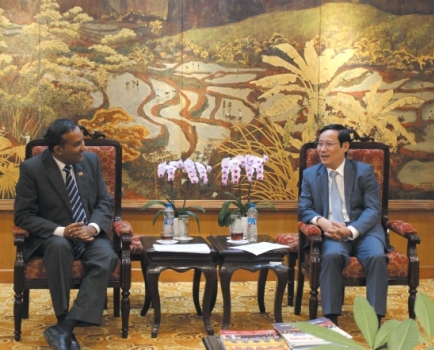

Dr. Can Van Luc – Chief Economist at BIDV, Member of the National Financial-Monetary Policy Advisory Council Discusses Capital Sources for SMEs

At the seminar, Dr. Can Van Luc, Chief Economist at the Investment and Development Bank (BIDV) and a member of the National Financial-Monetary Policy Advisory Council, highlighted the current state of capital for small and medium enterprises (SMEs) in recent times. He also assessed those businesses, particularly SMEs, are still facing difficulties; the scale of capital and financial leasing support funds is still too small compared to other support sources; and the international integration capabilities of businesses remain weak, making capital access challenging.

"The most significant issue with the capital structure in SMEs is the lack of funding. Without an effective access channel and if they borrow at high interest rates, businesses struggle to operate and face high risks. Domestic companies, especially SMEs, are not yet adept at mobilizing capital from the stock market, and Vietnamese businesses have not accessed international capital markets. They have also not effectively utilized financial mobilization channels, such as non-bank guarantee funds," Dr. Can Van Luc analyzed.

Opportunities for Businesses

Regarding solutions for capital sources for small and medium enterprises (SMEs), Dr. Can Van Luc, Chief Economist at the Investment and Development Bank (BIDV) and a member of the National Financial-Monetary Policy Advisory Council, stated that in relation to the project supporting SMEs, the Prime Minister is directing a comprehensive survey of financial credit channels that support SMEs, including a reduction in corporate income tax for these businesses.

VCCI is also proposing solutions to the government to enhance the effectiveness of the Law on Support for Small and Medium Enterprises; to build and diversify funding sources and support funds for businesses; and to use a single law to amend multiple laws to help alleviate difficulties for enterprises.

To address these challenges, experts emphasize that businesses need to broaden their understanding of the current state of capital access, including: potential funding sources, support policies, challenges in accessing capital, and diverse solutions to support SMEs in securing medium- to long-term financing, including financial leasing.

Through financial leasing, businesses can quickly deploy machinery and equipment, enabling them to meet large orders in a timely manner without incurring excessive costs.

Economic Experts and Business Leaders Discuss Solutions to Enhance Financial Access for Enterprises

Mr. Hoang Van Phuc, Deputy General Director of BIDV-SuMi TRUST Financial Leasing Company, analyzed that for businesses borrowing from banks who encounter difficulties and temporarily cannot repay on time, their loans will be classified as overdue. Consequently, these businesses will find it challenging to access additional bank credit. However, through the purchase and leaseback model offered by financial leasing companies, businesses can not only repay their bank loans but also "clean up" their balance sheets to secure additional working capital for production and business.

For those businesses with assets and efficient operations but lacking working capital, especially after exhausting their bank credit limits, the purchase and leaseback operations of financial leasing companies can help them restructure their debt, creating the capital needed to maintain and expand their business.

Thus, the issue of capital for enterprises has found a new solution, narrowing the gap between funding and business operations, providing businesses with additional channels for capital mobilization and solutions to enhance their production and business activities.

Sharing effective financial management solutions to improve competitiveness for businesses, Master Bui Quang Dung, Director of Training at TOT Business Development Solutions Company, stated that businesses need to develop detailed long-term and short-term financial plans, identify and minimize financial risks.

At the same time, they should strictly control costs, cut unnecessary expenses, forecast cash flow to ensure sufficient funds for payments, and use capital for specific purposes with clear plans that are efficient and legal.

Mr. Bui Xuun Sinh, Director of the VCCI Branch in Nghe An – Ha Tinh – Quang Binh, presents the Certificate of Merit from the VCCI Chairman to organizations and individuals who have made outstanding achievements in production and business.

As part of the seminar's activities, in celebration of the 20th anniversary of Vietnamese Entrepreneurs Day (October 13, 2004 - October 13, 2024), the VCCI Branch in Nghe An – Ha Tinh and Quang Binh organized a meeting with entrepreneurs and awarded certificates to new members of VCCI for 2024. They also presented Certificates of Merit from the VCCI Chairman to organizations and individuals who have excelled in production and business, contributing positively to the development of Vietnamese enterprises.

By: Hong Quang (Business Forum Magazine)/Translator: LeAnh-Bizic

---------------------------------------------

Same category News :