Credit management must ensure growth, inflation control

Fri, 14 Mar 2025 14:54:00 | Print | Email Share:

Credit management must support economic growth while ensuring inflation control and macroeconomic stability. This is something to be maintained by the State Bank of Vietnam (SBV) in 2025.

If credit does not flow into production, it may lead to inflation risks

If credit does not flow into production, it may lead to inflation risks

Credit management must support economic growth while ensuring inflation control and macroeconomic stability. This is something to be maintained by the State Bank of Vietnam (SBV) in 2025.

Fueling the economy

The Government has, for the first time, issued a resolution on growth targets for various industries, sectors and localities to ensure the country’s overall economic growth reaches 8 percent or higher. The Government held meetings to discuss strategies for helping businesses access resources, including credit from the banking sector.

The SBV’s latest data indicate that credit growth in early 2025 show positive signs compared to the same period last year, following the seasonal trend of the beginning of the year and the Lunar New Year period. Credit growth, in particular, and monetary policy, in general, are considered major driving forces of achieving an economic growth rate of over 8 percent in 2025.

SBV Deputy Governor Dao Minh Tu said the State Bank aims for an annual credit growth rate of 16 percent in 2025, equivalent to about VND2.5 quadrillion being injected into the economy. If the Government reaches its 10-percent economic growth target, credit growth will be 20 percent, equal to around VND3-3.2 quadrillion injected into the economy.

The SBV leader analyzed that most commercial banks have already maximized their safety ratio. When banks mobilize VND10, they can lend out VND9, with the remaining VND1 required for safety reserves. However, many banks are currently lending over VND10, meaning they have to use their charter capital and refinancing capital from the SBV to support lending activities. Specifically, while the total mobilized capital of the banking system currently stands at VND15.2 quadrillion, the amount being lent out to the market has reached VND 15.8 quadrillion.

The total outstanding credit is nearly VND16 quadrillion, while the gross domestic product (GDP) is VND12 quadrillion. This means credit amounts to 130% of GDP. Given that economic growth this year is expected to exceed 8 percent, this ratio will rise even further. “This is a highly complex macroeconomic challenge, but the banking sector has no choice but to take it on,” Tu said.

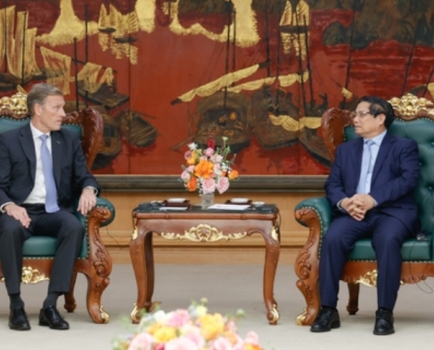

Credit growth is a major driving force of economic growth - photo: Duy Minh

Credit growth is a major driving force of economic growth - photo: Duy Minh

Balancing objectives

Experts have noted that when the Government sets high growth targets, inflation risks inevitably follow. Anticipating this, alongside adjusting the GDP growth target to over 8 percent in 2025, the Government has proposed to the National Assembly an increase in the average inflation target to 4.5-5 percent, higher than the 4 percent rate in recent years.

Meanwhile, the management of monetary policy in general and credit policy in particular must not only support growth but also help control inflation and stabilize the value of the Vietnamese dong. This task is crucial, requiring the SBV to closely monitor market developments.

Dr., Economist Vo Tri Thanh pointed out that injecting money into the economy can stimulate growth. However, the key is to ensure that growth is both rapid and sustainable. Sustainable growth must be tied to macroeconomic stability and rely more on labor productivity and technological advancements.

On the other hand, analysts warn that strong credit growth can easily lead to inflation. If a large amount of money is pumped into the economy, but does not flow into productive sectors, it could trigger inflation and create various economic and banking system challenges.

“Past experience shows that asset bubbles can become difficult to control, leading to a rise in bad debts, which threatens the stability of Vietnam’s banking system. These are critical concerns when expanding credit,” cautioned Dr. Nguyen Tri Hieu, a finance and banking expert./.

| Governor of the State Bank of Vietnam Nguyen Thi Hong stated that the SBV will closely monitor global and domestic economic developments and proactively implement appropriate solutions to help control inflation, maintain macroeconomic stability, stabilize the monetary market and banking operations, and ensure the safety of the banking system. She emphasized that this is a crucial task and a fundamental pillar for the sustainable growth of the economy. |

By: Ngan Thuong/ VEN

Source: https://ven.congthuong.vn/credit-management-must-ensure-growth-inflation-control-56895.html

---------------------------------------------

Same category News :