Cake by VPBank spices up micro-investing game after tie-up with Dragon Capital

Tue, 12 Apr 2022 15:34:00 | Print | Email Share:

As micro-investing gains traction, Cake by VPBank is the latest big name in fintech to inch its way into the micro-investing space by launching a new product in partnership with Dragon Capital. With a customer base of 1.5 million users just 14 months after its launch, Cake by VPBank is expected to bring substantial changes to the micro-investing market.

Over the past two years, Vietnam’s stock market has experienced a surge in retail investor participation. The number of new stock brokerage accounts opened by retail investors doubled in 2020, and in the first half of 2021, the total number of new accounts was more than the number of new accounts in 2019 and 2020 combined.

| CAKE by VPBank signed the partnership with Dragon Capital |

In this context, several fintech investing apps have introduced micro-investing options to serve the rising demand of novice investors who are looking to get their feet wet in the stock market. Micro-investing is the practice of investing tiny amounts at a time, equivalent to putting spare change in the stock market. It is also a good strategy for people who do not have a lot of money to invest, and it can help them learn more about saving, compounding growth, and long-term returns.

With cash in the bank earning next to nothing in interest, investors are turning to micro-investing smartphone apps to place money into shares to grow their savings. In particular, micro-investing apps have become more popular among young-generation investors.

Cake by VPBank, a young and dynamic digital bank operating on a new technology platform, is not lagging behind in this trend. Cake signed the strategic partnership with Dragon Capital VietFund Management JSC (DCVFM) to offer a micro-investing product. With this product, Cake allows investors to put VND10,000 ($0.44) or more into the DC Income Plus Bond Fund, which is managed and operated by DCVFM.

Nguyen Huu Quang, CEO of Cake said, “Our digital banking platform offers a one-stop service for individual customers. We deliver financial solutions that meet the versatile demand of young customers, including payments, investments, savings, consumer loans, and salary advances. With Cake’s micro-investment product, even a young graduate can make investments easily without any capital barriers.”

Quang emphasised, “We believe that this is an opportunity for young people to learn more about managing their finances.”

Accordingly, Cake has designed a beginner-friendly investment feature with a simplified interface, which makes the transition into investing much less intimidating. Investors can also enjoy numerous advantages when investing through Cake. To cite one example, Cake’s micro-investing product will offer a higher degree of safety to investors, as all of their money will be invested in a portfolio of bonds and term deposits.

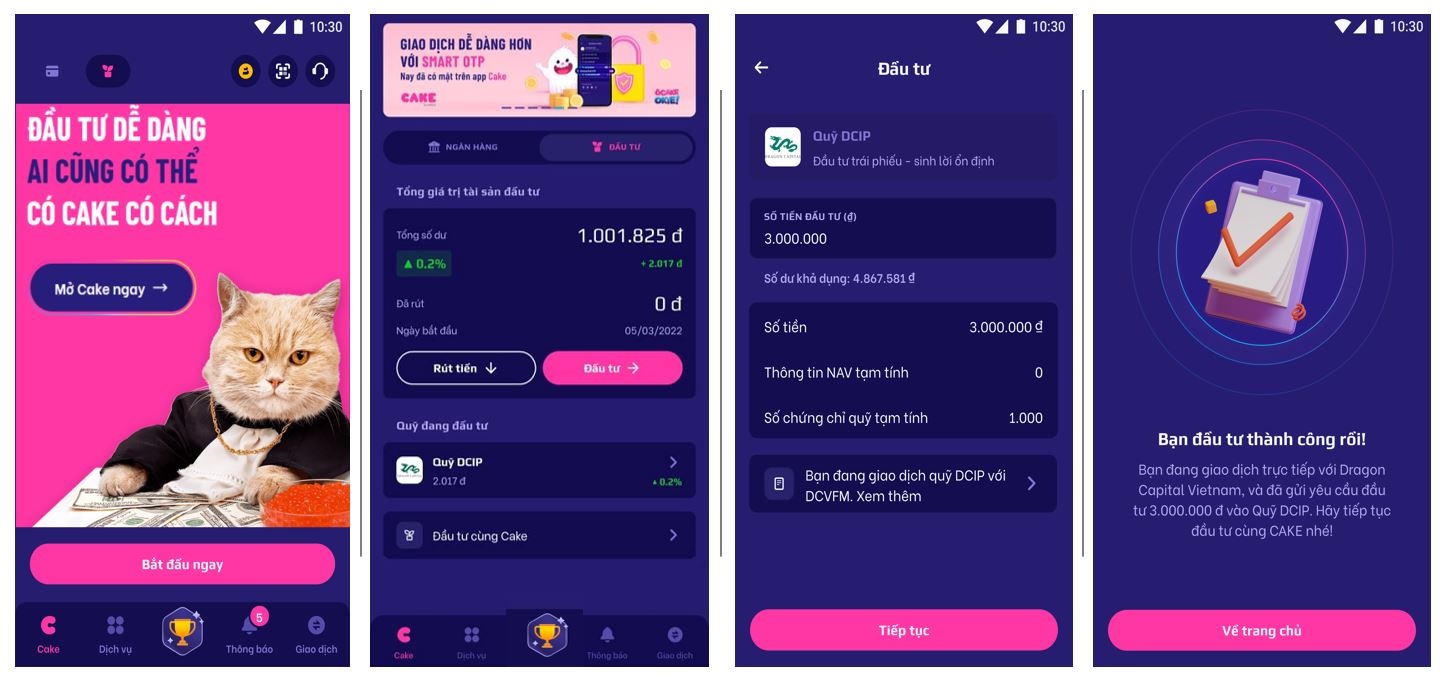

| Interface of the investment feature on Cake |

In addition, investors can start small by investing their idle money, starting with as little as $0.44. Another plus is the high liquidity of micro-investing. Investors can sell fund certificates to withdraw money on any trading day of the week. The money will be returned to their bank account within 24 hours from the time of placing the sell order. Profits are calculated according to the actual investment time, without early penalty fees.

Moreover, Cake also provides stable profitability to investors with investment returns of up to 6 per cent per year, which is the target set by DCVFM. This rate is much more attractive than short-term deposit rates.

The tie-up between Cake by VPbank and Dragon Capital will likely boost micro-investing in the Vietnamese market. Cake, a collaboration between Be Group and VPBank, is one of Vietnam's fastest-growing digital banks, with over 1.5 million customers just 14 months after its launch. Cake has also replaced its core banking technology in just 74 days, a record for Asia-Pacific.

Cake also benefits from BE Group’s ecosystem, with a customer base of 10 million users, most of whom are young, tech-savvy, and live in large urban areas. BE Group is expanding quickly with its online services, ranging from motorcycle sharing, car sharing, express delivery, grocery delivery, and so on. This diversity allows BE customers to use the spare change from their everyday transactions to invest with Cake.

| Cake has gathered 1.5 million users after a little more than a year |

Dragon Capital is Vietnam's oldest independent asset manager, with over 25 years of experience under its belt. Dragon Capital Group currently manages more than $6 billion in assets, providing the most diversified investment fund products in the market. Open-ended funds managed by DCVFM have been leading the industry in terms of return in many years.

Dominic Scriven, chairman of DCVFM said, “Micro investments are not new to the world, but have yet to be widely applied in Vietnam. I believe that Cake’s first micro-investment product will be an attractive option for millions of Vietnamese investors. As a young digital bank, Cake has quickly scaled up its operations, backed by a great leadership team and strong core values. We have therefore decided to enter into a strategic partnership with Cake as we believe in the app’s bright prospects.”

The partnership between Cake by VPBank and Dragon Capital offers an affordable and safe approach for investors, thereby paving the wave for a new investment trend in Vietnam. The two organisations are both expected to benefit from their collaboration.

Specifically, Cake plans to launch more micro-investing products professionally managed by Dragon Capital in 2022, such as the DC Bond Fund, the DC Dynamic Securities Fund, and the DC Blue-Chips Investment Fund. Meanwhile, Dragon Capital can speed up its digital transformation by teaming up with fintech partners like Cake.

In the end, investors will be the biggest beneficiaries of the micro-investing trend. They can access financial services from professional fund managers and invest right on a one-stop digital platform, which makes it more convenient for them to optimise their capital and build their wealth without spending too much time and effort.

By: Thanh Van/ Vietnam Investment Review

Source: https://vir.com.vn/cake-by-vpbank-spices-up-micro-investing-game-after-tie-up-with-dragon-capital-92586.html

---------------------------------------------

Same category News :