Fiscal revenue growth to remain under SOE divestment pressure

Sun, 28 Apr 2019 15:45:00 | Print | Email Share:

VOV.VN - Fiscal revenue growth is forecast to remain under pressure due to a persistent delay in the divestment of state-owned enterprises and lower import tax revenues, said an overseas research unit.

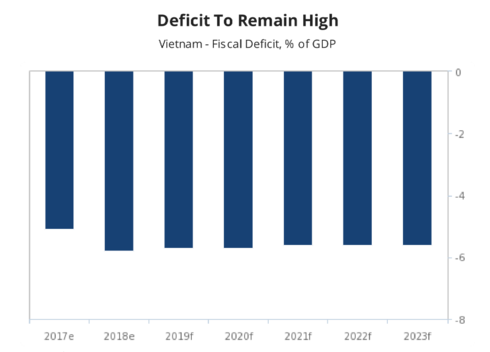

Source: Ministry of Finance, Fitch Solutions

Fitch Solutions, a macro research entity of Fitch Group, said in a recent report that Vietnam's fiscal deficit would stand at 5.7 per cent (including interest repayments) in 2019, relatively similar to the government’s 5.8 per cent estimate for 2018.

It stressed that the headwinds to revenue growth will constrain the government's capital spending.

Of note, the slow pace of state-owned enterprises (SOE) divestment will continue to weigh on fiscal revenue growth. In August 2017, the government set a target to divest 406 SOEs by 2020, with 135 SOEs set for divestment in 2017, and 181 in 2018. However, only 13 were divested in 2017 and 52 in 2018.

According to the Corporate Finance Department (CFD) under the Ministry of Finance, the government has identified a further 18 SOEs to be divested in 2019 and will continue the divestment at an additional 41 SOEs from the 2018 list.

Fitch Solutions quoted comments by Dang Quyet Tien, head of the CFD, as saying that some of the key challenges facing the SOE divestment include poor interest from investors, the SOE's scale of business and assets which ‘require careful valuation to avoid losses for the state budget’.

Land - related issues remain another hindrance to the SOE divestment as some SOEs had not completed their land use plans before submitting them to government agencies.

Meanwhile, though the Ho Chi Minh (HCM) benchmark equity index is trading at a premium of 17x earnings relative to its Asian peers at 13x earnings, Fitch Solutions still noted that the premium has fallen in recent months. This suggests dropping interest in the Vietnamese stock market in relation to the region.

Should the stock market see downward volatility over 2019 as a result of risk-off sentiment on fears of slowing global growth, this could hamper investor appetite for Vietnamese SOEs looking to divest by means of an initial public offering, said the research entity.

Investor interest in local SOEs has so far been weak. Last September, the state-owned Vietnam National Shipping Lines managed to raise only US$2.3 million for its 35 per cent stake sale, far underperforming the firm’s target of US$200 million. Similarly, the state-owned Viglacera Corporation reportedly failed to lure a wave of investment after it announced a plan to sell a 19.97 per cent stake last July.

Vietnam’s drive to foster greater bilateral and multilateral trading relations will also weigh on import tax revenues. In recent years, the country has been aggressively pursuing trade pacts with different countries.

Adding to the country’s current 10 free trade agreements (FTA) are six more in the pipeline, including the Regional Comprehensive Economic Partnership, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and the EU-Vietnam FTA.

Most notably, it is believed that the gradual removal of import tariff lines under the CPTPP will act on import tax revenues over the coming quarters.

Moreover, the nation’s high debt burden will likely constrain capital spending. Fitch Solutions cited media reports from September 2018 as showing that the Ministry of Planning and Investment estimated the country’s public debt-to-GDP ratio to be at 61.4 per cent at the end of 2018.

The government has set a public debt ceiling at 65 per cent of GDP for the 2018-20 period. Although the estimated ratio in 2018 fell from 63.7 per cent in 2017, it nonetheless remains close to the 65 per cent limit.

Earlier this year, a high-speed rail project was restarted. The project, aimed to improve links between the north and south, is expected to be opened in stages from 2030 onward. Fitch Solutions believes that funding this project would weigh heavily on the government’s finances, particularly given that the government has to bear 80 per cent of the total bill.

As the public debt-to-GDP ration is close to the government’s 65 per cent threshold, the research firm noted the risk of a cutback in capital spending in other areas to fund the rail project, or even delays to the scheme.

The initiative was first proposed in the early 2000s, with its original completion slated for 2035. However, at an estimated cost of US$56 billion at the time, the project was deemed too expensive by the government, which eventually shelved the project in 2010.

However, Fitch Solutions declared that risks to its forecast are for a larger fiscal deficit as the government could decide to prioritize growth over fiscal prudence amidst slowing economic growth.

This could make the government borrow more to fund its expenditures, with the increase in interest repayments putting further downside pressure on the fiscal deficit over the long term.

By: VOV

---------------------------------------------

Same category News :